NESL PAYROLL SERVICE COVERAGE

As organizations continue to expand, managing payroll processes merits special consideration. To build, manage, and implement payroll-related operations and processes, one requires an organized approach. NESL focuses on payroll services to ensure:

- Tax-efficient management

- Efficient and timely administration

- Regulatory compliances

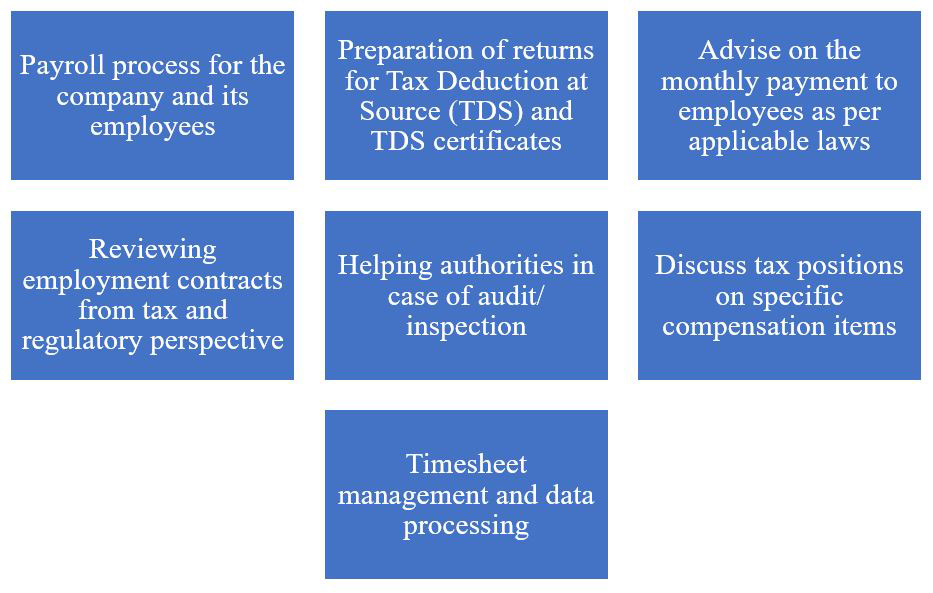

NESL offers the following services with regard to the payroll functions:

Most large enterprises transfer payroll services to third parties, as outsourced solutions are time- and cost-effective and more flexible and offer greater control for a company with large operating networks. NESL offers its services to its client by managing the payroll services in an efficient and accurate way.

The NESL payroll system maintains records of all employees irrespective of the nature of their payment (monthly or daily or hourly). Detailed records of take-home salary, tax deduction, workman’s liability insurance, medical history, personal accident insurance, gratuities, leave/severance/holiday/family allowance, medical/mobile/per diem/transport/annual allowances, bonus, termination pay, pensions, payment in lieu, sick/annual/casual leave calculation, and other benefits (accommodation, foreign allowance, etc.) are kept for future reference.

Sometimes, depending on the offer and nature of work, separate arrangements for work clothing, personal protective equipment, and medical examinations are provided.

The benefits and packages are up to the client and individual consultant/employee to agree on. NESL executes payroll administration as agreed by the parties.

PAYROLL DIAGNOSTIC

Due to its sensitivity, compliance, and volume, it is a service to be performed with near accuracy. As a result, effective payroll services require specialization and a clear understanding of the applicable laws.

With cross-border experience and exposure of NESL in dealing with a significant number of multinational companies operating in Bangladesh, NESL stands out to be one of the most experienced companies in dealing with local and expatriate payroll services.

Key service offerings:

NESL’s key service offerings include:

- Review existing employee compensation policies:

- Identify cost-ineffective components arising from admin or potential litigation costs

- Suggest tax-efficient compensation items wherever possible

- Review withholding tax computations, statements, and payments for adequacy of compliance

- Verify documents with regard to reimbursement claims from a tax compliance perspective

- Identify potential tax and penalty exposures due to non-compliance

- Highlight tax exposures that may lead to litigation with mitigating measures

- Evaluate cost-saving opportunities for viability and consistency within corporate philosophy

- Recommend implementable ‘leading practices’ on payroll policies and procedures

- Review applicability of Bangladesh labor laws.

EMPLOYEE COMPENSATION STRUCTURE

Expatriates of the high-skill category within certain industrial sectors receive significant compensation in the form of salaries, allowances, and benefits. However, international competitive biddings and changing global market conditions, along with resource sourcing from various regions, are putting pressure on organizations to be cost-conscious while remunerating employees in a tax-efficient manner.

BIDA prescribes a minimum salary structure for expatriates working in Bangladesh.

It is focused on ensuring that the structure that is offered meets:

- Minimum mandatory BIDA-prescribed salary

- Flexible and employee-friendly in terms of relocations, rotations, and work schedules

- Meets contractual requirements of clients

- Cost-effective

- Simple to administer

- Tax efficient

- Aligned with industry practices

Key service offerings:

-

- Use the NESL salary database to match with the package offered to the new client

- Use a globally published salary review

- Examine other compensation structuring options available to the organization

- Review BIDA salary recommendation

- Analysis of the current employee compensation structure so as to:

- Advise on the tax implications thereof

- Weed out policies that are not cost-effective due to administrative costs or potential litigation costs.

- Advise on the estimated tax liabilities based on potential compensation offerings

- Design a standard manual containing payroll policies and procedures

- Identify potential tax, interest, and penalty exposure (if any) for regulatory violations.

TAXATION SERVICES

NESL provides taxation services, which in turn save time and cost for clients and employees from managing complex accounting processes and mitigate their related compliance issues.

The services are as follows:

-

- Cross-border tax planning for the client

- Arranging issuance of Tax Identification Number

- Tax planning and management for local personnel

- Tax planning and management for foreign personnel

- Tax deduction / withholding tax at source and deposit to government treasury

- Issue a salary certificate mentioning tax deduction and deposit

- Tax return submission, tax assessment, and obtaining a tax certificate